Achieve a Self-Sufficient Retirement, or Better!

- Even if you don't have any idea how

- Even if you don't have 1 million nest egg

- Even if you think you don't have much net worth

- And even if you think you already know everything there is to know about retirement

What is the most important consideration in retirement?

Click PLAY to Learn More

|

The founder of RetireMethod program has also been featured in the following media channels & organizations |

Why so many accountants by training joined RetireMethod?

Scroll to the bottom of this page to know why I was invited to speak to an audience of Certified Practising Accountants of CPA Australia back in 2013

RetireMethod was helpful in the sense that it validates my own calculations. It is good to know that I now have a second opinion that confirms my own calculations. I am now more confident that my money will last if I manage it according to plan. I also know now how to adjust to external conditions beyond my control. It also helps to know additional information on how to react in case of a bad year of investment returns, how to adjust for inflation as shown in the course.

Choong Yong Khean, 54 (Bukit Mertajam), Retired, Ex-Sales Manager

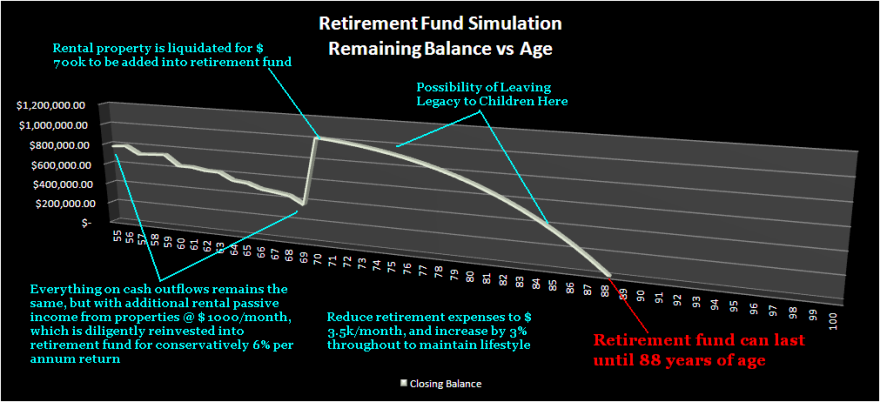

Likely Outcome* of your Retirement Nest Egg Before & After RetireMethod Program

(Using RetireMethod Scenario Modelling & Visualization Tool)

*Case study simulation. Your result may vary

BEFORE

AFTER

RetireMethod gave me the reassurance that what I have done and am doing so far is on track; and as lifetime member, I can come back to the program 1,5 or 10 years down the road to check if I am still on track.

Also, the delivery method of the program is more effective than if I were to engage you for say, 5 days – where I could not engage the content creator again after 5 days or ask questions or even feeling pressured to absorb everything within a limited duration

KS Lim, 56 (Petaling Jaya) On permanent sabbatical aka Retired, Ex Banker & Banking Software Consultant

With RetireMethod Scenario Modelling © you will be able to...

- Revise your Assumptions and Reconstruct your Retirement Roadmap on the fly

- Resolve the Inevitable Changes that occur over time by adjusting your plan

- Build Confidence by varying the inputs and see how it affects overall roadmap

- Know with High Certainty the Cause & Effect of every financial decision you make

- Become Better Informed and Educated from being sold products you don't need

- Get Second Opinion on how to better manage retirement nest egg

I wasn’t expecting to learn much, after all I was sceptical what you had to show/tell someone with many years of accounting background like myself. But after finishing the whole course, especially Module 4, I can honestly tell you it is Very Insightful. I thought I know all the concepts of retirement planning but you laid things out in a very different perspective – often making me think twice about what I thought I knew. CCRIS

Choo Heng Hee (Damansara) Finance Manager, Commercial Accounting

I'm an accountant and spent many years working in most areas of accounting and finance. I have my own retirement plan and worksheet, which is not as comprehensive as yours. I took your course to see whether I missed out any key considerations.

RetireMethod has achieved its objective for me in giving me a "second opinion" that I have a fairly robust retirement plan in place, with many factors taken into consideration.

Your course will benefit those who don't have any plan or have little idea of how to go about planning for their retirement the most.

Mr Phua (name changed to protect identity), Petaling Jaya

Investment Division Director (CLICK HERE to view actual email feedback)

Good stuff in this program! I think should include Trust/Will/estate, is because, sure enough we will retire one day, but how can we have a good succession of our assets to our family.

The thing I like most? The RetireMethod Visualization tool... it is good when people see the real numbers, then they have much clarity on their retirement road map. That could mean feeling relieved or feeling "shit, I've got to do something about this NOW!"

Howie Phang, Subang Jaya

Application Support Consultant, CSG International

I have my own retirement plans - being an accountant, I worked with numbers a lot. However, I joined RetireMethod because I wanted to know how the professionals in the financial planning industry do it. Now, I got a much clearer picture. Another plus point is that the fee you charged is very reasonable.

Poon Mun Leng, PJ

Accountant at a Malaysia MNC

Personally,the most helpful thing is that at least now I know whether my retirement fund is able to last until I kick the bucket. I can now manage the fund more effectively along the way with the help of your Excel worksheet (RetireMethod Visualization Tool) as a guide.

Cheong Sheong Ngai, KL

56 Retired (CLICK HERE to view actual email feedback)

Who is behind RetireMethod?

CF Lieu, Certified Financial Planner, Independent Financial Adviser Founder of HowToFinanceMoney.com, Malaysia Financial Planner, Penang Financial Planner and Featured CFP (Cert) Professional